Download ITR-V from Income Tax India Website

Categories

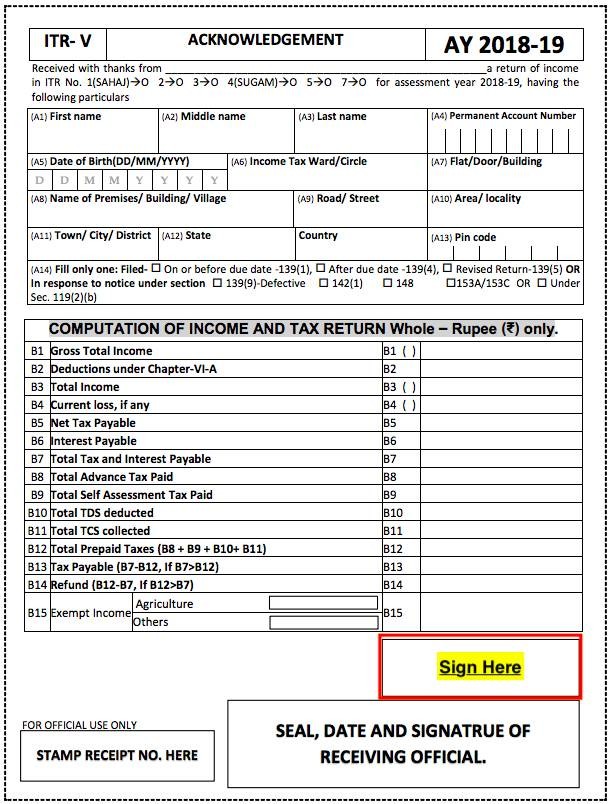

What is ITR-V?

ITR-V is the abbreviation of Income Tax Return Verification. The department of Income Tax generates this Income Tax Verification for the benefit if the Income Tax payers. The income tax payers are able to verify the legitimacy of their E filing of Income tax returns with the help of ITR-V.

ITR-V is needed to be submitted at the time of filing the e-Filing of Income Tax Return. ITR-V is not only a one-page document for Income Tax Return Verification, but also is the complete and comprehensive summary of the tax payer’s tax returns. This ITR-V is only received, when the income tax payer submits her/his online Income tax return without any digital signature.

The necessary guidelines for ITR-V

- The ITR acknowledgement form should be printed in black ink only. No other option to print an ITR acknowledgement form is acceptable.

- Only Sheets of A4 size should be used for ITR acknowledgement form.

- Never to type or write anything on the back of the print of this form.

- Never to submit any other document with the covering letter.

- Never to use stapler on ITR-V acknowledgement.

- Never to submit photocopies of signatures.

- Always to use an inkjet or a laser printer to print this ITR-V acknowledgement form.

- Never to use dot matrix printer.

- Never to print any type of water mark on the ITR-V form.

- Make sure of making the bar code and the numbers below the bar code to remain clearly visible.

- Make sure the print out of the form is absolutely clear.

- The ITR-V form can be sent by post or speed post to the office address at Bengaluru.

How to download ITR-V Acknowledgement from Income Tax India Website?

This application of ITR-V is only for those income tax payers, who file their income tax returns without any digital signature. It has now become very easy and convenient to get the income tax payer’s ITR-V, from the comfort of the tax payer’s homes or their offices.

Steps to Download ITR-V Acknowledgement

You can download ITR-V Acknowledgement by following below steps-

One needs to go to the web site of Income tax department and Click on “log in here”. In case the user already has an account on this web site. Or the income tax payer can click on “Register Yourself” button for creating a new account. One has to enter her/his credentials to log in to the portal.

One has to click on “e filed Returns/Forms” under the section of “My Account” from top menu, once the tax payer has logged in. Then, one needs to select “Income Tax Return” from the drop down and click on the button of “Submit”. One then just has to select the “View Returns/Forms” option to see for themselves their filed returns.

One then needs to click on the Acknowledgement number, to open the option of down loading ITR-V and to download the income tax payer’s ITR-V. The income tax payer can also select to E Verify her/his income tax returns. For this option of E Verify, one needs to select” Click here to view your returns pending for e verification”.

One needs to click on “ITR-V/Acknowledgement” to get her/his ITR-V, using the valid password.

The tax payer now has to select ITR-V/Acknowledgement, to start the download. The ITR Form and the ITR number are protected by passwords. If the tax payer wants to open the PDF file, she/he has to enter her/his PAN number, in lower case. In case of individual tax payers, the date of birth of the tax payer needs to be entered. For non-individual tax payers, the date of incorporation has to be entered in the format of DDMMYY, without giving any space in between the data of PAN number and the date fields.

To cite an example of this subject, if the PAN of a certain income tax payer is ABCDE1234A and her/his date of birth is November 17th, 1985, the password will be abcde1234a17111985. It is to be kept in mind that the date of birth or the date of incorporation has to be exactly same as was given in the respective forms of the income tax returns.

Now, the tax payer has to enter the password, so obtained as cited above, after downloading ITR-V Acknowledgement, to be able to open the document. The password is the PAN number of the income tax payer. This is the lower numbers in the tax payer’s PAN along with her/his date of birth.

To provide an example of the above, if PAN is AAAPA1111F and the date of birth is 01/01/1975, the password will be aaapa1111f01011975.

ITR-V Submission to CPC in Bangalore

Now the income tax payer has to get this document printed, after putting her/his signatures on the document and arrange to send this signed document to the Central Processing Centre, CPC, Bangalore. This has to be done within 120 days of filing the document, from the date of E filing the income tax return. The address for sending ITR-V is:

Income Tax Department – CPC Post Box No.1, Electronic City Post Office, Bangalore-560500, Karnataka

Any income tax payer’s E filing only becomes complete, when the Central Processing Centre or CPC of the Income Tax department sends an E mail or SMS, acknowledging the receipt of the It form. This form is of ITR-V. Here this form stands for Income Tax Return Verification form. This form is just a one-page document.

Once an Income Tax return is filed, the department of Income Tax sends the ITR-V to the registered E Mail ID available in the data base of the department, pertaining to that particular PAN.

Another Method to Download ITR-V Acknowledgement

There is another method to download ITR-V Acknowledgement-

- First Login to the government’s Income Tax e-filing portal.

- Then, go to “My Account” tab

- Next, click on “View e-Filed Returns/Forms”

- After that, select “e-Filed Returns/Forms” from the drop-down list

- Next, click on “Submit” button

- Then, click on the respective assessment year’s “Acknowledgement No.”

- Lastly, click on “ITR-V/Acknowledgement” option from the new dialogue box to download ITR-V.

It is always possible to send a number of ITR-V forms, in a single mailer. One can club her/his ITR-V with the ITR-V of her/his family members or friends.