How to Generate E-Way Bill on E-Way Bill Portal?

Categories

GST Services

What is an E-Way Bill?

As the name suggests, an E way bill is an electronically generated bill. This E way bill is an electronic bill that is created for transportation of goods from one destination to another destination. This E Way bill can be generated on the web portal of E way bill.

An E Way bill is a mandatory provision for any goods valuing for more than Rs 50,000/-, which are to be moved from one place to another place. This evaluation of goods is made on Single invoice or by a bill. It can also be made through a delivery challan. This movement of goods in a vehicle cannot be made by a registered person, in absence of an E Way bill.

An E way bill can also be generated or cancelled through the use of SMS service. An E Way bill can be generated by the use of the related Android App or by web site to web site integration, through the use of an Application Programming Interface.

A unique E way Bill Number or EBN is allocated and made available to the supplier, to the recipient and to the transporter of the goods, the moment an E Way bill is generated for transportation of goods.

Requirements for generating an E-Way Bill

The E-Way bill portal provides a unique solution for generating E Way bills with both the options of generating Single E Way bill or generating Consolidated E Way bills. This portal can also be used for changing the number of the vehicles on E way bills those have already been generated and for cancellation of the generated E Way bills. This portal has many other uses too.

E Way bills can be generated through two methods:

- E way bill can be generated on the web site.

- E way bill can be generated through SMS service.

There are certain requirements for generating an E Way bill, for both the methods of generation of E Way bills. These are-

Steps to Generate E-Way Bill Online on E-Way Bill Portal

Login to E-Way Bill Portal

Step 1 - One must log in to E way bill system. The users name, password and Captcha code should be entered and click on “Log In” at E-Way Bill generation portal at https://ewaybill.nic.in/

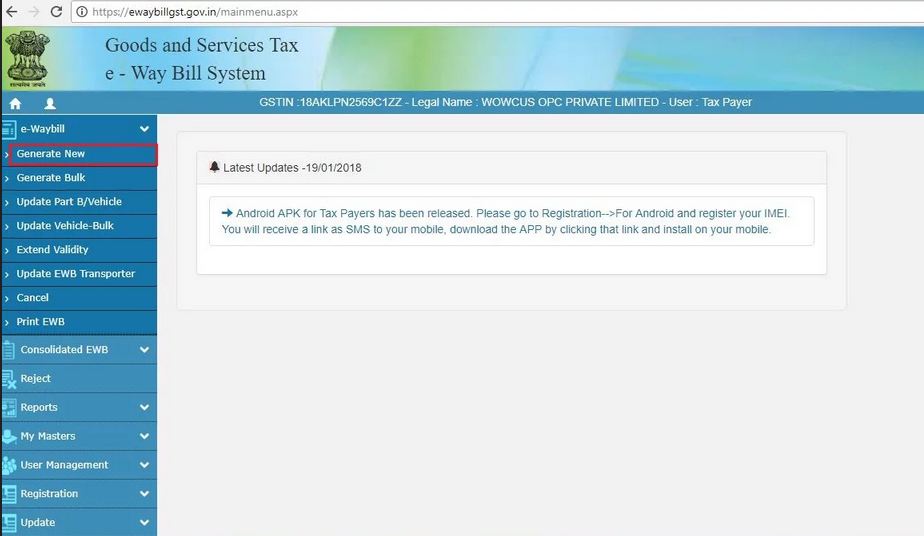

Step 2 - One has to go to the option of “Generate New” under “E Way Bill,” that is appearing on the left-hand side of the dashboard.

Generate E-Way Bill

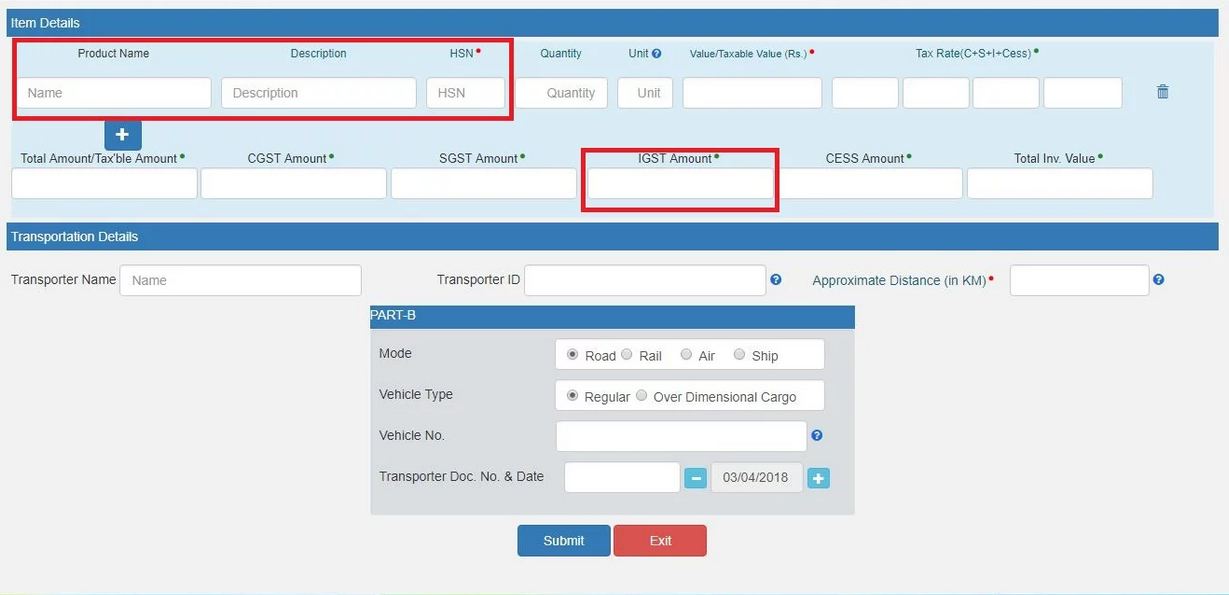

Step 3 - One needs to enter the under mentioned fields, appearing on the screen-

To enter details of From or To, depending on the applicant being the supplier or the recipient. The applicant is to mention URP, if the person is an Un Registered Person.

Enter Goods Description

Step 4: The second half of the page will contain information to be filled as follows:

Step 5 - To click on “Submit”. The system will validate the data entry if found correct or reject it if there is an error in data entry.

If the entries are made correctly, the system will generate an E way bill in form of EWB-01 form with a unique twelve-digit number E-Way Bill Number or EBN.

Finally, the E way bill is generated by the portal.

The applicant can take out a Print Out of the E-Way bill-

Step 1 - To click on “Print EWB” sub option under the option of “E Way Bill”.

Step 2 - To enter the relevant E way Bill number, the unique twelve-digit number and click on “Go”.

Step 3 - To click on “Print” or “Detailed Print” button, on the E Way Bill that appears on the screen.

Generate E-Way Bill through SMS Service

E Way bills also can be generated through SMS service. One needs to type the message, code_input info, and send the message to the mobile number of the state from which the user that may be either the tax payer or the transporter is registered. For Example - 97319 79899 in Karnataka

How to register for SMS facility?

Step 1 - Login to E-Way Bill Portal.

Step 2 - Click on “Registration” appearing on the left-hand side of the dashboard and select “For SMS” from the drop-down.

Step 3 – You will see the partly displayed mobile number which is registered for GSTIN. Click on “Send OTP”. Enter the OTP generated and then click on “Verify OTP”. That’s it, you are registered for SMS facility.

Note - A maximum of two mobile numbers can be registered against one GSTIN

What Clients Say

Prakash Verma

Praveen Chauhan

Pradeep Kochhar

Blogs

In today's dynamic business landscape, navigating through various regulatory requirements and financial obligations can be... Read More

FinacBooks is a reliable platform that helps business owners in getting verified leads. It offers various services and solutions that can... Read More

Starting a new business in India requires several legal procedures, paperwork, and timely compliance with regulatory authorities. Company... Read More