Introduction to LIC of India

LIC, also known as Life Insurance Corporation, is one of the India’s oldest, and leading, life insurance company. It is established in 1956. Once a time, LIC is the only insurance service provider in the company. It has offered insurance solutions to millions of customers. It has launched a wide variety of insurance solutions to fulfill the demands of the Indian customers.

It has offers services all across the India. By offering some very good life insurance plans, backed by the years of innovation, LIC is rated among some of the most popular, trusted and reliable life insurance providers in the country. LIC is the only public-sector investor in India. It is the most trustworthy and highly recognized names in the Indian life insurance sector.

With its widest range of worthwhile life insurance policies grouped across various segments and its ever-growing list of happy clients across the nation. Therefore, this is also the main reason, why LIC is ranked among the top insurance companies in the world.

But here is a fact, which is very disturbing. To submit the premium, many LIC policy holders spends many hours standing in the long queues at various branch offices of the LIC. The main reason of this is that most of the policy holders of the LIC does not know the procedure of paying premium online. To pay the LIC premium online, it is not necessary for the customers to stand under scorching sun and in the long queues.

Also, it is very simple to make payment of LIC premium online. It takes few seconds and few clicks of the mouse. The fantastic online premium payment facility is available to all the policyholders of the LIC, regardless of the kind of LIC life insurance product they owned.

By using the LIC online premium payment services, a customer can easily check his policy status and other important policy details, and can easily pay the premium online. Also, it is not important that the customer is registered with the LIC website or not.

In this article, we will disclose the process of making the online payment for submitting the LIC premium in few simple steps.

LIC Premium Online Payment Facility

A tool named LIC Pay Direct is introduced by the LIC. This tool helps you in paying your LIC premium online without going through the LIC Online Registration procedure.

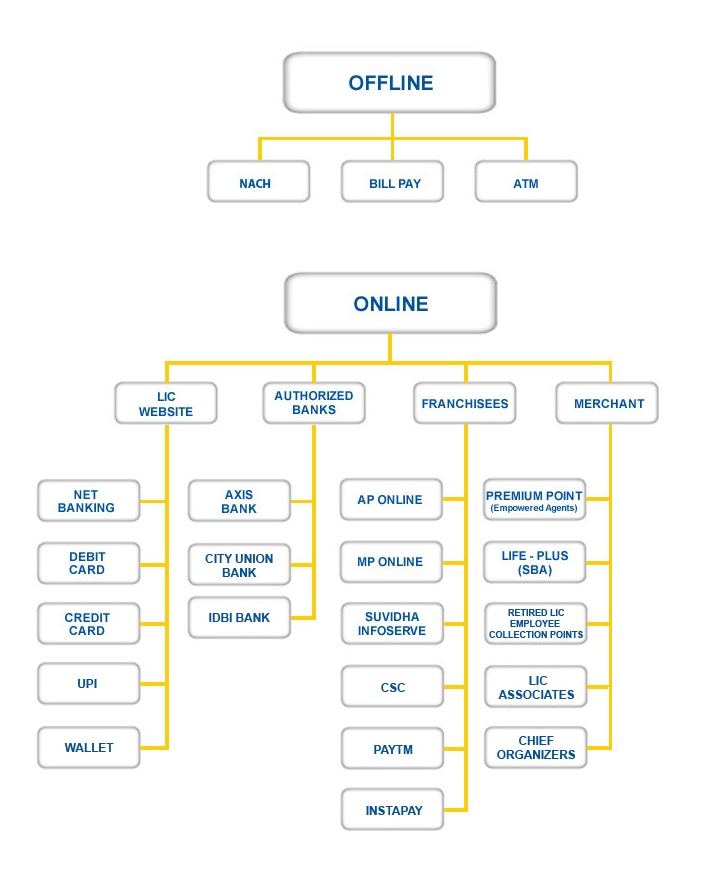

With the world of insurance and banking is online, more and more customers were now preferred the convenience of making premium payment online. With innovation and time, the channels of making payment have become more and more advanced. For the benefit of their policy holders, LIC provides various channels through which the policyholders can make payments.

Payment of premium for the LIC policies can be easily done online by using various methods like at merchants, at franchisees, at authorized bank branches, and from the LIC website. Here we have created a list of all the choices through which customers can make premium payments for their LIC policies online.

LIC Premium Payment Channels

| Merchant | Franchisees | Authorised Banks | LIC Website | Wallets |

| Premium Point | AP Online | Axis Bank | Net banking | Paytm |

| Retired LIC Employee Collection | MP Online | Corporation bank | Debit Card | |

| Life-Plus (SBA) | Easy Bill Pay | Credit Card | ||

| Suvidha Infoserve |

Online LIC Premium Payment for Non-Registered or Registered Users

The facility to pay premium online has been initiated by the LIC to make the procedure of making premium payments safer and quicker. The online payment facility is offered to customers who have registered their policies on the Official LIC portal, as well as for those customers, who are not registered. The procedure for making the premium payment is different for both the two types of customers.

But, it offers the similar convenience of making payments from anywhere, and anytime. Customers can pay the premium of their life insurance policies online with a few clicks of the mouse and can enjoy life insurance services without any interruption.

Let’s quickly understand how you can easily make online LIC premium payment with registration and without registration.

Online LIC Premium Payment: Pay Direct (Without Login)

Step 1 – Visit LIC Official Website to Pay Premium Online

Step 2 – Click on Pay Direct (Without Login)

Step 3 – Select Option from Renewal Premium/ Revival

Step 4 – On the next page, click on the Proceed button. Fill up the Customer Validation form with your vital policy details - Policy Number, Installment premium, Date of Birth, Email Id, and Mobile number. Upon filling up the form, simply verify the ‘Captcha’ code, accept the agreement, and hit the ‘Submit’ button.

Step 5 – Verify your policy details and hit the ‘Proceed’ button.

Step 6 – In this step, you will select your payment option. Choose how you want to make the payment - Credit Card, Debit Card or Net Banking. Now simply make your LIC online premium payment.

Step 7 – Remember to check your registered email to get the payment receipts. Print and download the premium payment receipt for your records.

Online LIC Premium Payment through Customer Portal

Step 1 – Visit LIC Official Website to Pay Premium Online

Step 2 – Click on Through Customer Portal

Step 3 – Enter your User ID/Email/Mobile, Password, Date of Birth and Click on “Sign In”

You will be redirected to the customer portal after sign in. Find “Self/Policies” option in this page.

Step 4 – Click on “Self/Policies” to view the details of your policy. Find your LIC policy renewal/due date and see the “Pay Premium” option if your policy renewal is due.

Step 5 – Click the Pay Premium option to proceed and provide the required information.

Choose the payment option from Credit Card, Debit Card or Net Banking and make payment. Don’t forget to check your registered email to see the payment receipts. Print and download your premium payment receipt.

Other LIC Payment Facility to Pay Premium

To make the payments for policies and plans in a convenient and secure manner, LIC has make a special website called as “Online Payment Gateway”, which is a demand based premium collection service. By visiting this website, customers can conveniently make payments of premium in a secure manner and in real-time through net banking. Customers can also make online payments of premium through debit card or credit card.

This facility is only provided to those customers who have enrolled their LIC policies on the LIC portal and registered themselves on the LIC website. Customers requires to remember few important points related to payment of premium through online payment gateway.

- Premiums can be paid for ordinary policies under monthly, quarterly, half-yearly, and the yearly mode of premium collection. Premium is paid only for in-force policies.

- Customers from outside India can also make payment of premium online via debit card, credit card or net banking.

- The channel of making payments is completely safe as data of policy is not shared in this procedure. The paid amount is completely encrypted.

- Customers do not need to pay any charge or fee for the online payment service.

- The payment gateway is IDBI for payment through credit card. Payment gateway is BillDesk for payment through internet banking or debit card.

- For the net banking method of payment, customers need to visit the LIC website to discover the banks which are authorized by LIC for making the payment of premium online. LIC supports all the major banks.

- Customers can receive the receipt for the premium payment on the website. The receipt can be printed and is sent to the policyholder through email.

- Advance payment period is fifteen days for the term insurance plan. Till the policy is in-force, the payment of premium can be done thirty days before the due date.

- If you pay the premium after the due date, a late fee at the rate of eight percent (minimum five rupees) is levied.

- For the upcoming financial year, premium can’t be paid.

LIC Premium Payment through Bank

LIC has partnered with India’s two prominent banks to offer extra convenience to their customers for paying the premium for the LIC policies. Customers of LIC can make the payment of premium at Corporation bank or Axis bank branches. However, there are few factors to consider regarding the payment made via these banks:

LIC Premium Payment through Franchisees/Authorized Collection Centres

LIC has also partnered with a number of private and government owned companies and service providers to provide the facility of payment of premium to its customers. The four service providers under the Franchisees are Easy Bill Limited – a one of a type alternate bill payment service which is convenient and secure provide bill payment services through traditional family neighborhood stores, Suvidha Infoserve – an s commerce organization which offers various types of bill payment services, MP Online – official website of the Madhya Pradesh government, and AP online, the official website of the Andhra Pradesh government.

When you make payment of premium through any of the authorized collection centers, which are mentioned above, you need to remember:

- Payment of premium will only be taken by cash.

- You can pay premium for only those policies which are active. For those policies, which are fall under SSS (Salary Savings Scheme), the collection centers will not accept payment.

- The facility for payment of premium is totally free.

- If you are making premium payment through a government owned collection center, then premium can be paid only for that specific state.

- A late fee at the rate of eight percent (minimum Rs. 5) is charged for the late premium payments.

- For the coming financial year, premium cannot be paid.

- The authorized collection center will issue a signed receipt after receiving the payment of premium.

- On the website of the LIC, customers will find the nearest collection center.

LIC Payment through Agent/Merchant

LIC has authorized some agents or merchants, who collect the premiums from the LIC policyholders. The persons authorized to collect premium are Retired Employees, Development Officers (Senior Business Associates) and agents at premium points. Here is some important information related to collection of premium by authorized agents.

Online LIC Premium Payment via Credit/Debit Card

Apart from net banking, you can also make the payment of premium for the LIC policy by using your debit card. The method for doing this is easy to understand and simple. Payments through credit/debit card will be perform through the IDBI gateway. To initiate the process of premium payment using your debit card, you can quickly follow Step 1 to Step 13 provided under “Online LIC Premium Payment Via Net Banking”. After that you required to follow the steps provided below.

You need to click on the option “IDBI Gateway”. It will redirect you to the next page, where you will discover various types of cards along with services tax and convenience fee. Choose the card, for which you want to make the payment. You’ll receive the total amount payable along with the service tax applicable. Click on the “Submit” option after choosing the type of card.

Next, you are redirected to a page, here you need to enter your credit/debit card details for transactions processing. The information includes your registered phone number, email ID, CVV number, date of expiry and card number. You also need to enter the captcha code.

After entering all the details, you need to click on the “Pay” option. It will generate a payment receipt and will send to your email id registered with LIC.

I hope you will find this information useful. Now, you can submit the LIC premium online. It can also save you from the inconvenience of standing in the scorching sun in the long queues.

LIC Premium Payment with Paytm

LIC policy premium can be paid with Paytm either by Paytm app (android & apple) or Paytm website.

Step 1 – Select “Pay Premium”

Step 2 – Select “LIC of India” from Insurer list.

Step 3 – Enter Policy Number and click on “Get Premium”

Step 4 – Make Payment