Employee Provident Fund

If you were scouring through the internet trying to learn how to check EPF balance online, you’ve made your way to the most precise blog post on this topic. Here, we will be covering all the necessary steps required to check your EPF balance using various methods.

There are an innumerable amount of people in India who are still unable to access their EPF passbook to check their EPF balance. Most of them aren’t even acquainted with the android app, UMANG, which allows for checking EPF balance simply using a phone.

However, before we plunge into details, let’s understand a bit about EPF.

So what is an EPF?

Short for Employee Provident Fund, EPF is a sum of money contributed by the employee and the employee of a company as deductions from the salary. It is like a safekeeping of your own salary for future use. You can withdraw it later in bulk upon meeting EPFO criteria.

Ways to Check EPF Balance

We’ve enlisted a list of 7 different ways in which you can check your EPF balance.

- EPFO Website

- EPFO Android App

- Use UAN Number

- Give a missed call

- Send an SMS

- Download EPF statement

- Download EPF passbook

How to use EPFO portal to check EPF Balance?

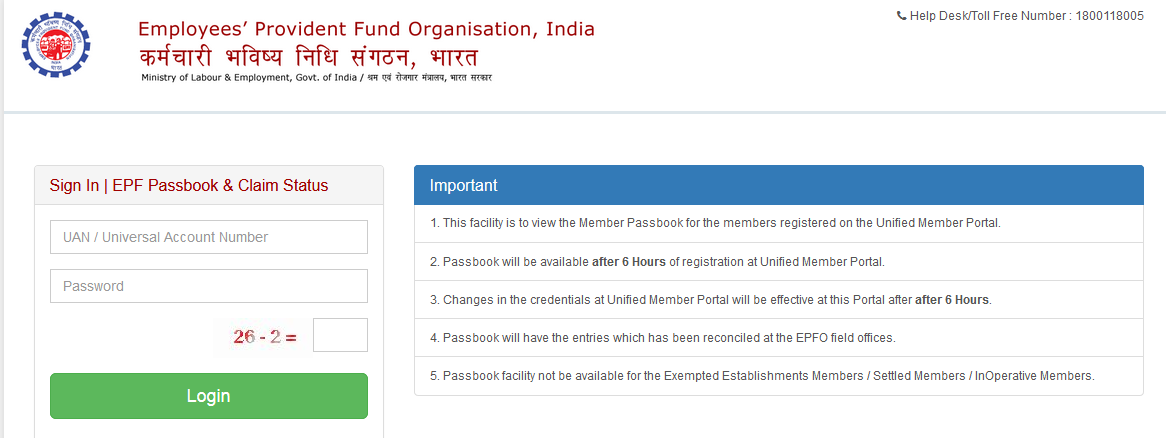

You need to have your UAN number activated in order to check the EPF balance. UAN is short for the Universal Account Number provided by EPFO. If you haven’t received your UAN number yet, make sure your employer has done the aforementioned. Here are some easy steps to follow to check your EPF balance using EPFO portal.

- Log In to the EPFO portal

- Go to the OUR SERVICES Tab

- Select FOR EMPLOYEES option from the dropdown

- Then select MEMBER PASSBOOK under SERVICES

- A Login page will appear.

- Enter your UAN and password

- You will find member IDs of all accounts with your UAN

- Click on the member ID of the EPF account to check the balance

How to use Android App to check EPF Balance?

It is quite easy to check your EPF balance using the android app. Follow the simple steps below to use your phone to check the balance:

- Make sure your UAN is activated.

- Download UMANG, the m-sewa android app of EPFO from Google PlayStore, Apple Store or Windows Store.

- Open UMANG app and go to EPFO option.

- Click on the Employee Centric Services option.

- Click on the ‘View Passbook’ option.

- Now enter your registered mobile number and UAN, and let your system verify your number.

- Select the ID to check the balance using UMANG app. Your passbook will be displayed along with your EPF balance.

(If the number doesn’t match, it will show an error. You won’t be able to see your EPF balance if this happens. You need to click on ‘Get OTP’ to send the OTP to your number, and later log in using that OTP.

How to dial a missed call to check EPF Balance?

It is very easy to check your balance with a missed call. However, you need to have your UAN account linked with your bank account, Aadhar Card or PAN Card. Ask your employer to help you with the integration process.

Once your UAN is linked to your KYC, follow these simple steps:

- Give a missed call at 011-22901406 from your registered number.

- Consequently, you’ll receive an SMS with your EPF details.

How to send an SMS to check EPF Balance?

You can also opt for the SMS option to check your EPF balance. However, you need to have your UAN account linked with your KYC such as Aadhar Card, PAN Card & Bank Account. Ask your employer to help you integrate it in a hassle-free manner:

Follow the instructions below to send the SMS and check your balance:

- Send SMS to phone number: 7738299899

- You need to type EPFOHO UAN ENG.

- You can use EPFOHO UAN HIN if you want to send SMS in Hindi language.

(You can send SMS in several regional languages available here like Marathi, Gujarati, Malayalam, Punjabi, Hindi, Tamil, Telugu, and Kannada).

How to use UAN to check EPF balance?

- Visit UAN official website

- Enter your UAN number and password

- Hit the option ‘EPF Passbook/Statement’

- Now you can download or email the statement.

Learn how to find EPF Balance Status:

- Provide your PF account number upon choosing your EPFO office.

- Leave the field blank if your account doesn’t have any extension field.

- Enter your name and registered mobile number. Your number is also recorded along with your EPF number.

- After the submission, your EPF details will be sent to your email ID.

Conclusion:

With the help of our guide, checking EPF balance through multiple streams or ways will never be an issue. It is highly essential to keep a tab of these things as well. I hope our short and precise blog post suffices to answer all your queries about EPF.