What is a Routing Number?

A routing number is meant to disclose the location from where an account was opened. Under the banking system, banks often asked customers for their checking account routing number when they make a payment by phone or through the online route.

Routing Number is also known Routing Transit Number, ABA Routing Numbers, or RTNs. Clients can see their full account number and routing number when they log in to do Online Banking. Very often clients end up finding a link in the "I'd like to'' list on their checking account transactions page.

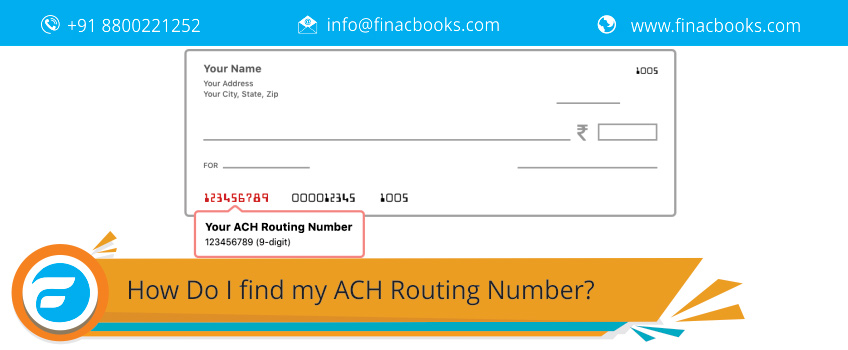

Where do I find my ACH Routing Number on a Check?

Any bank routing number comprises of a nine-digit code based on the US Bank location where an account was opened. Printed on the bottom of your checks it is the first set of numbers on the left side.

Second set of numbers printed at bottom of the checks are the account number (usually 10-12 digits) specifically associated with the personal account.

Otherwise, clients can also find their account numbers mentioned in their monthly statements.

What is the difference between ABA and ACH Routing Number?

In a different terminology, an ACH Routing number is also known as an ABA number.

Patrons or clients can find out their account’s ABA number from several types of sources.

Firstly, if a checkbook is handy, the easiest approach would be to find out the number from the numbers listed at the bottom of the check.

In case of paper checks an ABA number is printed on every single check. Usually it is the 9 digit number listed on the left hand bottom corner.

In case of computer generated checks it could appear elsewhere. (Say for instance, in the case of business or online bill payment checks).

In another way, clients can also find their ABA number on deposit slips belonging to the same location.

In case it is still not working customers can get in touch with their bank and simply ask which ABA number to use.

Few banks provide this information online, but still customers would need to log into their accounts to find the right number or better still they can search their bank’s website and seek out for Automated Clearing House (ACH) information.

Also Read: Receive and Transfer Money From Abroad To India

Correct Number Usage Makes All the Difference

A client’s bank can have several ABA numbers. In such a case it is essential to use a number specific to one’s account.

It is the same number one can find printed on the checks or clients can even call in their banks and ask for a number.

Herein, one thing needs to be noted that ABA numbers differ depending on where a bank account was opened and bank mergers could even lead to multiple codes for a same bank.

If in case there is a doubt, customer service representative from the bank should be asked about which number to use. As number might be different for ordering checks whereas different numbers might be needed for electronic bill payments and wire transfers.

Mechanism behind ACH Routing Number

For the most part, all that is needed is to copy the ABA number and provide it when asked for. Banks take care of things after that.

Provide the number along with the account number to anyone who needs the number to do automatic transfers.

Wherever a bank fails or merges clients end up getting a new ABA number. However, before using the same number right away, clients need to ask the bank if they can continue using the old numbers until new checks come in or before a sign up is done for new services.

In most scenarios, old routing numbers can be used for an indefinite time frame.

Process behind the ACH Routing Number

1st four digits come from the Federal Reserve Routing System and are assigned by it.

They represent the bank's physical location because acquisitions and mergers are involved. Such numbers frequently do not correlate with bank’s geographic location in the present.

Fifth and sixth digits denote the Federal Reserve Bank the institution's electronic and wire transfers will be routed through.

Seventh digit denotes the Federal Reserve check processing center which was initially assigned to the bank.

Eighth digit denotes the Federal Reserve district the bank is located in

Ninth digit provides a checksum. A checksum is a complicated mathematical expression using initial eight digits.

In case the end result does not come equal to the checksum number, a transaction is flagged and manual processing is done after rerouting.

To conclude, An ABA number is an address that tells everybody where to find an account.

So as a result, ABA numbers can also be called routing transit numbers (RTNs). “ABA” is a very commonly used term because American Bankers Association (ABA) works towards assigning such numbers to banks.