How to Setup PayPal Business Account in India?

What is a PayPal Account?

Introduced in the year 1998 by Max Levchin and Peter Theil, PayPal is a payment gateway i.e. a web based application to facilitate transfer of funds between member accounts. Main aim behind introducing PayPal was to make online shopping and electronic payment as easy as taking out money from your wallet. One would just need to enter the recipient’s email address and the amount of money you intend to send it to them. Setting up a PayPal account and sending money via it doesn’t cost you anything; however, if you wish to receive money via PayPal, you need to check the fees for the same. Ever since the idea of PayPal was conceived till now, PayPal has gained its credibility in form of a reliable and secure payment gateway because it uses already existing infrastructure used by various financial institutions and credit cards. Also, it gives special emphasis on secure transaction and thus uses advanced fraud prevention technologies.

Today we live in a multi-country and multi-currency world and in order to justify and synchronize with the same, PayPal supports over 100 currency and if you are a merchant, you can earn in 57 currencies. Also, in order to be easily accessible by anyone, PayPal is both iOS and android compatible. Salient features of PayPal are as below:

- Its annual maintenance charge is nil.

- Transaction fee per transaction: 4.4% + US $0.30 + currency conversion charges.

- It has same day settlement policy i.e. all payments of same day gets auto-withdrawn to your local bank account on a daily basis.

- To start your PayPal account, all you would need is your PAN Card, a local bank account and a purpose code. Aim behind introducing purpose code is to see if the cross border transactions comply with the regulatory requirements and businesses are required to furnish the correct purpose codes from pre-filled dropdown section.

- Approx 341,497 websites across the world have got PayPal as their authorized payment gateway.

PayPal hit the limelight when it appeared as a payment facilitator for eBay auctions and in due course of time PayPal attained so much of popularity that it was made official transfer service for eBay and by the year 2015, PayPal became an independent company and ever since then millions of traders across the world use PayPal as their payment gateway.

How to set up business PayPal account in India?

When you start working online, you would need to set up the method in order to receive and send payment and to do so, you would need a payment gateway in place, preferably the one which deals in multi currency and language so that you can expand your business or work without thinking twice and PayPal is one such payment gateway which fulfills most of the requirement of a trustworthy payment gateway. Setting up a PayPal account for your business is quite simple, irrespective of whether you want to do the business locally or across the globe. Apart from what mentioned above, PayPal has its fair share of advantages, such as:

- You don’t have to worry about your credit card details being exposed and thus saves you from online theft.

- PayPal accepts debit cards as well thus those who don’t have credit cards, can avail services of PayPal.

- Unlike most of online services where you have to make recurring payments, with PayPal you can cancel the recurring payments at any point any point of time.

- PayPal gives you the option to create and send invoices directly to your clients.

- Bulk payment is also possible with PayPal.

Steps to Create PayPal Business Account

In order to set up a PayPal account, one need to follow below mentioned steps:

Sign Up to Create a PayPal Business Account

The first and foremost step to create a PayPal account is to create an account with it and in order to do so, visit www.PayPal.com and click on “Sign Up” to create the account. Once you visit the webpage, you will have two options to choose from i.e. whether want to create an individual account or business account. If you are a starter, it is always better to start with personal account and later on upgrade to business account if required.

Enter Card Details in PayPal Business Account

Once you select from the business or personal account, you would be asked to fill up a form which is basically a sign up form where you have to add certain details as asked. A business PayPal account in India is a limited PayPal account and can be used to both send and receive the payment using both credit and debit cards. As mentioned in above lines, sending money through PayPal doesn’t take much however in order to receive money, you need to fill in following details in the signup form:

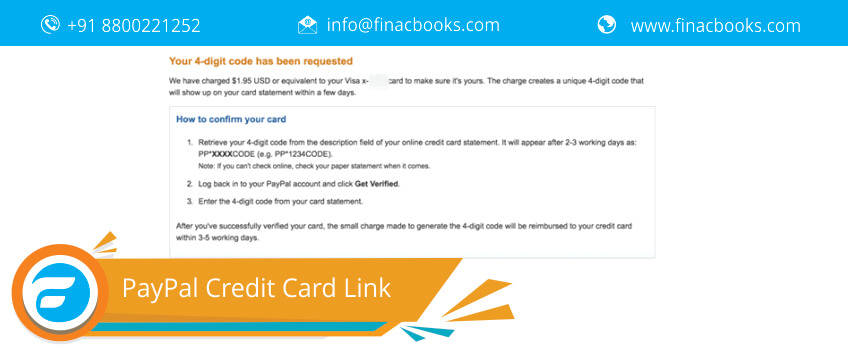

Link Credit Card and Debit Card with PayPal Business Account