Home / TNREGINET

TNREGINET is the online registration portal of Tamil Nadu government where citizens can easily access the government land records online. It eliminates the visits of citizens to sub-registrar office for online checking of land records.

Features Of TNREGINET

The features of TNREGINET are as follows –

Online booking for appointments at sub registrar office

Web-camera and biometric based registration process

Provision for Aadhar number based services

Appeals process management

Dynamic real time market valuation

Financial MS & Reporting

Compatibility provisions for integration of land records application

Work flow based operations with comprehensive audit trail

Procurement & maintenance of hardware infrastructure

Full proof service delivery

Personnel profile maintenance system

What Is Included In Our Package?

Eligibility Consultation

Document Preparation

Application Drafting

Government Fees

Services Provided on TNREGINET

The services provided by TNREGINET are as follows –

- Online marriage certificate service

- Online encumbrance certificate service

- Online certified document service

- Online chits document service

- Online society document service

- Online EC status check service

Procedure Of User Registration in TNREGINET

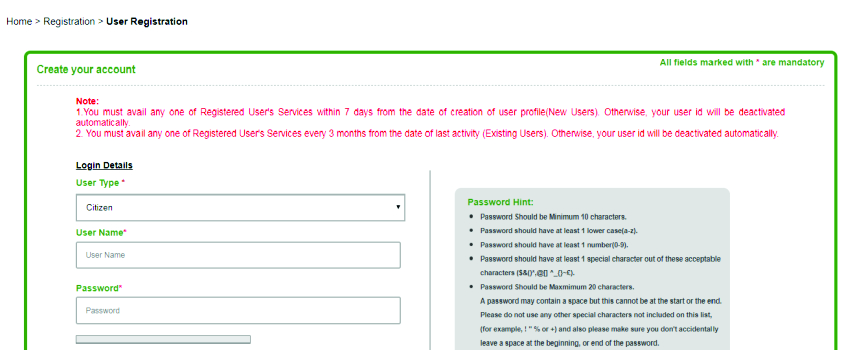

TNREGINET website not only help citizens in creating deeds but also helps in doing registration for marriages, chits, society and firms in document creation or abstract for draft deed. The procedure of user registration on TNREGINET is as follows –

1Step 1 – Firstly visit the website https://tnreginet.gov.in/portal/

2Step 2 – Secondly, start creating your account by putting the username of your choice in the username text box. It must be a combination of alphanumeric & symbols.

3Step 3 – Make your password by following the password rules displayed on the right side of the screen. Password will be accepted if it is highlighted in green color else you have to input the password again in the text box. In the next step, you have to enter the password again in the “Confirm password” box.

4Step 4 – In step 4, you need to select the security question from the drop down list and answer the same.

5Step 5 – In step 5 – You need to enter the personal details in the respective fields given below –

Procedure For Registration as a Document Writer

In case you need to register as a document writer, you need to enter the following details below –

- 6Step 6 – In order to register as a document writer, you need to input the following details in the respective boxes –

7Step 7 – In the step-7, you need to provide the information related to business address of the document writer.

8Step 8 – In step-8, you need to provide the registration details of the document writer to the registration district with the sub-registrar office attached too.

9Step 9 – In the last step, enter the captcha code appearing in the picture. Click on receive OTP. You will receive one OTP on your registered mobile number. Enter the OTP in the respective field and click on complete registration.

Note – After completing the registration, you can easily log in by “signing in” into the portal.

Checking Property Status/ Land Registration Online (EC STATUS)

In order to check the property status or land registration details online, you need to follow the below mentioned procedure –

Step 1 – Click on “EC search” option from the homepage. It will redirect you to the next page.

Step 3 – In step 3, you need to enter the survey and sub-division number.

Step 4 – Enter the captcha and click on search to view your property status online.

Guideline Search

In order to search the guidelines, you need to follow the procedure mentioned below -

Benefits of TNREGINET

What Clients Say

Prakash Verma

Praveen Chauhan

Pradeep Kochhar

Blogs

In today's dynamic business landscape, navigating through various regulatory requirements and financial obligations can be... Read More

FinacBooks is a reliable platform that helps business owners in getting verified leads. It offers various services and solutions that can... Read More

Starting a new business in India requires several legal procedures, paperwork, and timely compliance with regulatory authorities. Company... Read More